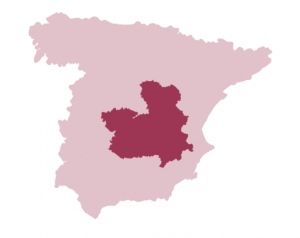

Castilla-La Mancha offers a wide range of industrial land and industrial areas throughout its territory to invest in different real estate sectors, such as residential housing, logistics centers or other spaces that require large areas to build and develop their projects and business models.

The supply of industrial land in Castilla-La Mancha is a competitive advantage due to its quantity, strategic location and price, which makes it very attractive for all types of industrial and logistics activities.

In addition, the strategic location of the region is an important factor, since it borders 50% of the Autonomous Communities of the Peninsula (representing more than 56% of the national GDP).

Four of the six main highways of the State cross through Castilla-La Mancha, and the main railway lines that connect 14 of the 24 peninsular ports with the inland, make us a reference point for all influential activities in the center of the Peninsula.

Trends and challenges of the sector

The real estate sector continues to be a fundamental market for the Spanish economy. We are currently in a transformation period marked by the emergence of new players and investment opportunities

This sector is divided into different segments, which have evolved differently due to the Covid 19 pandemic. The most relevant changes that have taken place in the industry are:

- Negative impact on offices, hotels and commercial spaces which are currently recovering: These sectors have been impacted by confinement, the role of telecommuting, and mobility restrictions.

- Positive impact on the housing sector (both rental housing and social housing) and the technological development sector (with the creation of data or logistics centers).

These changes have taken place in recent months and have ushered in a number of trends (related to teleworking, online shopping or digitalisation) that will shape the real estate sector in the coming years:

- Boosting the logistics sector: as mobility has been restricted, online shopping has increased. In the wake of this change, new logistics centers have emerged, built on the outskirts of major cities or in areas of higher consumption.

- Changes in the housing market on three levels:

- The purchase of houses by users who already have a house but saw the opportunity to change it due to the pandemic.

- The purchase or sell of houses by foreigners has decreased sharply due to these mobility restrictions.

- Digitalisation has also drastically changed the housing market, as virtual viewings or mortgages can be applied for online.

- The role of flexible offices: With the advent of telecommuting, offices have taken a back seat. In recent months, hybrid work has been encouraged and new models such as co-working spaces or digital work centers have emerged.

- Boost in tourism after vaccination: as a result of Covid-19, tourism has declined worldwide, but thanks to progress in vaccination, we can predict a return on investment in this sector in Spain.

Investment opportunities in the sector

There are several sub-sectors in which you can invest within the real estate market, such as offices, logistics centers or residential buildings, which have undergone changes and adjustments in recent years.

-

Offices and retail

Despite of the pandemic and the rise of teleworking, offices remain one of the most profitable assets when it comes to investing to rent. The return is higher than investing in residential property and means less cash outlay. Office space remains one of the most profitable assets when it comes to investing for rent.

On the other hand, commercial premises in some capital cities have higher average profitability than offices, for example. This type of property offers the highest profitability and is the only property whose profitability has increased since the fourth quarter of 2019 (8.9%).

-

Logistics

Logistics is a market that has been growing for years. Noteworthy is the boom and rapid growth of e-commerce in recent months, almost reaching the traditional market.

Large companies such as Amazon have set up logistics centers in our country and continue to do as they function as an operations base for both Spain and Europe. n addition, they are a link between our continent and Africa and a strategic point that connects to the Latin American market.

-

Residential real estate

This asset remains one of the strongest sub-sectors within the real estate sector when it comes to investing.

In January 2021, according to available data from the Bank of Spain, the gross rental yield was 3.7% in the third quarter of 2020.

According to the Idealista portal, Toledo (6.3%) and Cuenca (6.5%) are among the best cities for residential investment in Spain at the end of 2020 due to their higher profitability, surpassing large cities such as Madrid (4.9%) or Barcelona (4.5%).